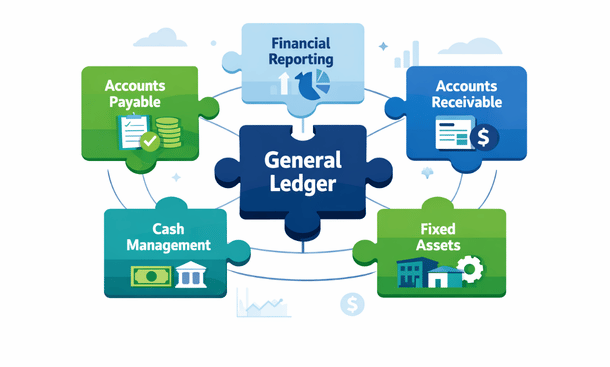

Look, I get it. You’re running a growing business in California, things are moving fast, and your finance setup is basically held together with duct tape and prayers. Maybe you’re using QuickBooks for invoicing, Excel for budgeting, another tool for payroll, and somehow your accountant is supposed to make sense of all this chaos every month. Sound familiar?

That’s exactly why financial ERP systems exist, and honestly, they’re kind of a game-changer once you understand what they actually do.

What does ERP even mean

ERP stands for enterprise resource planning, which is a fancy way of saying it’s software that connects all your business processes in one central system. Think of it like the operating system for your entire company. But when we talk about financial ERP specifically, we’re zeroing in on the money side of things.

A financial ERP system brings together everything related to your accounting, financial reporting, compliance, budgeting, and cash management into a single platform. Instead of data living in five different places and your finance team manually moving information around, everything flows automatically through one unified system.

The big difference between regular accounting software and a true financial ERP is integration and scale. QuickBooks is great when you’re small, but as you grow, you need something that can handle multiple entities, currencies, departments, and complex reporting requirements without breaking a sweat.

The core components that matter

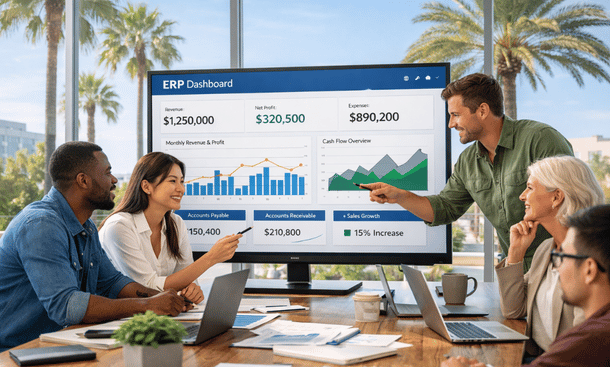

Every solid financial ERP system has a few essential modules that work together. The general ledger sits at the center, tracking every financial transaction that happens in your business. This is your single source of truth for all financial data.

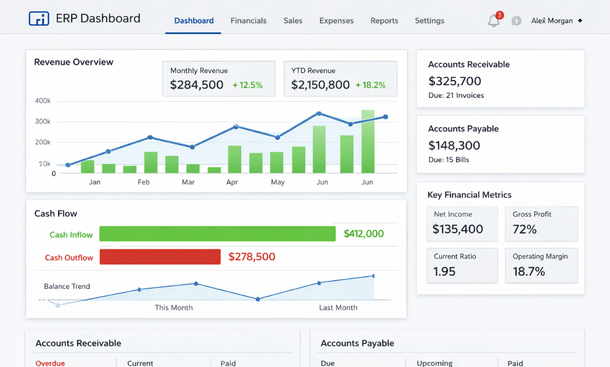

Then you’ve got accounts payable and accounts receivable, which handle money going out and coming in. These modules automate invoice processing, payment workflows, and collections, which saves your team countless hours every week.

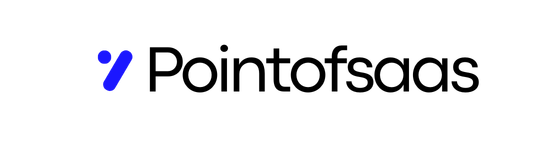

Financial reporting and analytics give you real-time visibility into your numbers. Instead of waiting until month-end to see how things are going, you can pull up dashboards anytime and see exactly where you stand. For California businesses dealing with investors or board meetings, this real-time access is huge.

Cash management helps you forecast and optimize your cash position. You can see what’s coming in, what’s going out, and plan accordingly. This is especially critical for startups burning through runway or seasonal businesses managing fluctuating cash flow.

Fixed asset management tracks your equipment, property, and other long-term assets, handling depreciation calculations automatically. Tax management features help you stay compliant with California state requirements and federal regulations without pulling your hair out every quarter.

Why California businesses are making the switch

California’s business environment is unique. We’ve got the highest concentration of tech startups and fast-growth companies in the country. We’ve got complex tax regulations. We’ve got businesses dealing with international customers and vendors. All of this creates specific challenges that basic accounting software just can’t handle.

The companies I see making the jump to financial ERP systems usually hit one of these pain points first. They’re growing so fast that their current setup can’t keep up. They’re preparing for funding rounds and investors want clean, auditable financials. They’re expanding to multiple locations or launching new product lines and need better visibility across the business.

Remote work has also accelerated adoption. When your finance team isn’t sitting in the same office anymore, having everyone work from a cloud-based ERP system instead of passing around Excel files makes collaboration way easier.

Real differences you’ll actually notice

The shift from traditional accounting software to a financial ERP system isn’t subtle. The first thing most teams notice is the reduction in manual data entry. When your systems are integrated, information flows automatically. Your sales data feeds directly into accounts receivable. Your approved purchase orders flow into accounts payable. Your bank transactions reconcile themselves.

Reporting becomes exponentially faster. Instead of spending three days pulling data from different sources to create your monthly board deck, you can generate those reports in minutes. Real talk, I’ve seen finance teams cut their month-end close process from two weeks down to three days just by implementing proper ERP systems.

Audit trails and compliance become automated. Every transaction gets logged with timestamps and user information. When auditors come knocking or you need to track down a discrepancy, you can trace everything back to its source in seconds instead of digging through filing cabinets or email threads.

Multi-entity management becomes possible without hiring an army of accountants. If you’ve got multiple legal entities, subsidiaries, or business units, a financial ERP can consolidate everything while still maintaining separate books for each entity. This is essential for California businesses with complex corporate structures.

The cloud factor changes everything

Most modern financial ERP systems run in the cloud, which matters more than you might think. You’re not dealing with servers, backups, or IT infrastructure. Your team can access the system from anywhere, whether they’re working from the office in San Francisco, their home in San Diego, or a coffee shop in Santa Cruz.

Updates happen automatically. You always have the latest features and security patches without disruptive upgrade projects. Cloud systems also scale with you. Need to add more users or modules as you grow? It’s usually just a settings change, not a massive implementation project.

Security in cloud ERP systems is typically way better than what most small to mid-size companies can implement on their own. These platforms invest millions in encryption, access controls, and compliance certifications because that’s their core business.

Common misconceptions worth clearing up

A lot of California entrepreneurs think ERP systems are only for huge enterprises with unlimited budgets. That used to be true, but the market has changed dramatically. Cloud-based financial ERP options now exist at price points that make sense for businesses doing a few million in revenue, not just Fortune 500 companies.

Another misconception is that implementation takes forever and disrupts your entire business. Modern systems are designed for faster deployment. We’re talking weeks or months, not years. The key is starting with core financial modules and expanding from there, rather than trying to implement everything at once.

People also worry that their team won’t adapt to new systems. Change management is real, but financial ERP platforms today are designed with user experience in mind. They’re intuitive, with interfaces that feel more like consumer apps than old-school enterprise software.

Getting started without overwhelm

If you’re considering a financial ERP system, start by documenting your current pain points. Where does your finance team spend the most time? What manual processes drive everyone crazy? What reports do stakeholders request that take forever to produce?

Talk to your accountant or CFO about what they need. They’ll have specific requirements around reporting, compliance, and controls that should drive your decision. If you don’t have a finance leader yet, that’s actually a sign you might need an ERP system even more, since these platforms build in best practices and controls automatically.

Research platforms that fit your size and industry. A two-person startup has different needs than a fifty-person manufacturing company. Most vendors offer demos where you can see the system in action and ask questions specific to your situation.

Moving forward with confidence

Financial ERP systems represent a significant shift in how you manage your company’s money. The transition requires investment in both money and time, but for California businesses dealing with growth, complexity, or scale, it’s usually the right move.

The alternative is staying stuck with fragmented systems, manual processes, and limited visibility into your financial performance. That might work when you’re small, but it becomes a bottleneck fast as you grow.

Understanding what financial ERP systems actually do and how they differ from basic accounting software is your first step toward making an informed decision. From here, you can start evaluating specific platforms and figuring out which features matter most for your particular situation.

If you’re ready to compare specific platforms and see which ones California finance teams are actually using, our breakdown of the best ERP systems for finance teams walks through the top options with pricing, features, and real user feedback. And for a comprehensive look at how these systems fit into your overall finance strategy, check out our complete ERP for finance guide that covers everything from selection through implementation.

Did you find this helpful?

Your feedback helps us curate better content for the community.