Table of Contents

- Why Your Partner Choice Matters More Than You Think

- Essential Qualifications and Certifications

- Evaluating Industry Experience and Expertise

- Assessing Technical Capabilities

- Understanding Their Implementation Methodology

- Checking References and Past Performance

- Evaluating Communication and Cultural Fit

- Understanding Pricing Models and Contract Terms

- Post-Implementation Support and Maintenance

- Making Your Final Decision

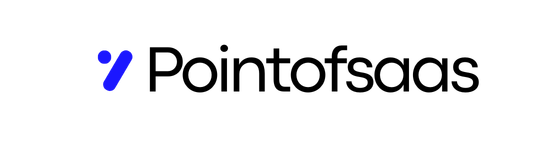

Choosing the right customization partner might be the most critical decision in your entire ERP journey—even more important than picking the software itself. A great partner brings deep technical expertise, understands your industry, and actually listens to your business challenges instead of just pushing their standard solutions. A bad one? They’ll burn through your budget, miss deadlines, and leave you with a system that’s harder to use than what you started with. When you’re ready to find someone who can effectively help you tailor your system to your business goals, you need a solid evaluation framework. Here’s your complete 2025 checklist.

Why Your Partner Choice Matters More Than You Think

I’ve watched too many California entrepreneurs make this mistake: they spend months researching ERP platforms and then choose an implementation partner based on whoever quotes the lowest price. That backward prioritization causes most failed implementations.

Your ERP platform is important, but it’s ultimately just software. Modern ERP systems from reputable vendors are all reasonably capable. What makes or breaks your implementation is how well that software gets configured and customized to fit your specific business needs. That’s entirely dependent on your implementation partner.

A skilled partner can make a mediocre ERP platform work brilliantly for your business. They know how to work around limitations, leverage hidden capabilities, and architect customizations that deliver maximum value. A poor partner can ruin even the best ERP system by implementing it badly, over-customizing unnecessarily, or under-delivering on critical features.

The relationship dynamics matter enormously. You’ll work closely with this partner for months during implementation and potentially years for ongoing support and enhancement. Personality conflicts, communication breakdowns, or misaligned expectations create friction that derails projects regardless of technical competence.

The cost of a bad partner extends far beyond the implementation budget. Failed implementations waste six to twelve months, consume enormous management attention, and create organizational change fatigue that makes future improvement efforts harder. I’ve seen businesses spend $100,000 with the wrong partner, abandon the implementation, and then spend another $150,000 with a different partner to do it right. That $250,000 total cost plus a year of lost time is devastating for a growing business.

Your partner becomes deeply embedded in your operations during implementation. They learn your business processes, understand your data structures, and build customizations that future developers will need to maintain. Choosing poorly creates long-term dependencies that are expensive and painful to unwind.

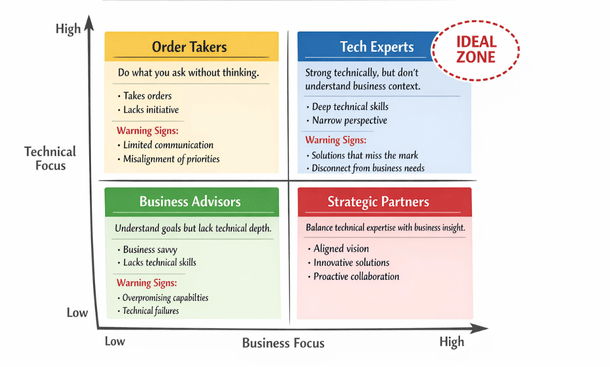

The right partner doesn’t just implement what you ask for—they challenge your assumptions, suggest better approaches, and help you avoid expensive mistakes. This consultative relationship only happens when you choose someone with genuine expertise and commitment to your success.

Bottom line: treat partner selection with at least as much rigor as you applied to choosing your ERP platform. The stakes are just as high, if not higher.

Essential Qualifications and Certifications

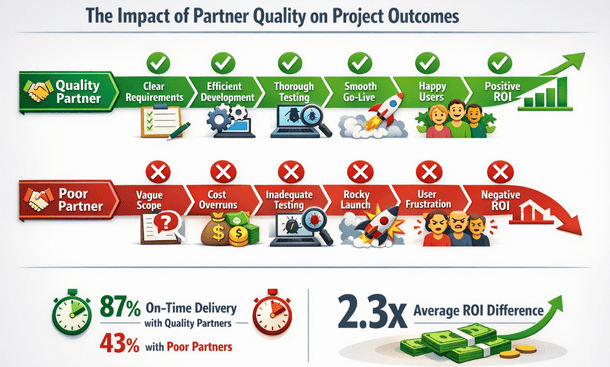

Let’s start with the baseline credentials that any serious implementation partner should have. These don’t guarantee quality, but their absence is a red flag.

Platform-specific certifications matter significantly. If you’re implementing NetSuite, your partner should have NetSuite certifications. For Microsoft Dynamics, look for Microsoft partner status and relevant certifications. SAP implementations require SAP partner credentials. These certifications prove the partner has invested in training and demonstrated competency on the platform.

Check the partner’s tier level with the vendor. Most ERP vendors have tiered partner programs—Gold, Platinum, Premier, or similar designations. Higher tiers typically require more certifications, completed implementations, and customer satisfaction scores. While tier doesn’t guarantee quality for your specific project, it shows sustained investment in the platform.

Individual consultant certifications within the partner organization matter as much as company credentials. Ask which specific consultants will work on your project and what certifications they hold. A partner firm with impressive company credentials but junior, uncertified staff assigned to your project isn’t what you’re paying for.

Industry-specific certifications add value for businesses in regulated sectors. Partners working with healthcare manufacturers should understand FDA regulations and 21 CFR Part 11 requirements. Those implementing for public companies need SOX compliance expertise. Food distributors need partners familiar with FSMA and HACCP requirements. Generic ERP skills aren’t sufficient for specialized industries.

Business analysis and project management certifications indicate professional discipline. Partners whose consultants hold PMP certifications, business analysis credentials, or change management certifications typically run more structured implementations. These process certifications complement technical platform knowledge.

Verify certifications directly with vendors when possible. Some partners exaggerate their status or let certifications lapse. Most ERP vendors have partner directories where you can confirm status. A few minutes of verification prevents unpleasant surprises.

Ask about continuing education and recertification. ERP platforms evolve constantly, and partners need to stay current. Partners who invest in ongoing training for their teams maintain expertise as platforms add new capabilities. Those who coasted on credentials earned five years ago might not know current best practices.

Don’t be impressed by certifications alone—they’re necessary but not sufficient. A certified consultant who doesn’t listen, communicate clearly, or understand business needs will still deliver poor results. Treat certifications as a baseline qualification, not a decision factor.

Evaluating Industry Experience and Expertise

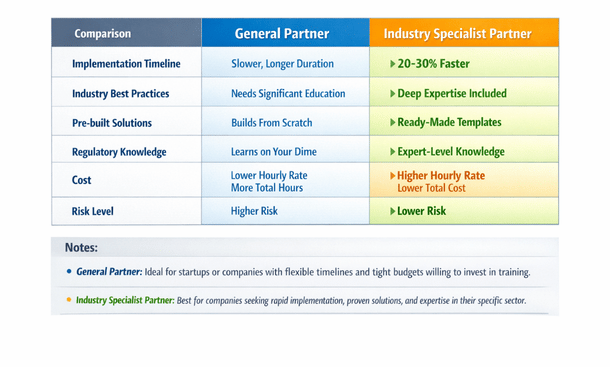

Industry experience dramatically impacts implementation quality. Partners who’ve implemented for businesses like yours understand your challenges intuitively and bring proven solutions.

Ask specifically about implementations in your industry. Don’t accept vague statements like “we work with lots of different industries.” You want concrete examples: “We’ve implemented for eight apparel retailers in California over the past three years, ranging from single-store boutiques to fifteen-location chains.”

Request case studies or success stories from similar businesses. Good partners document their implementations and can share anonymized examples showing challenges faced, solutions delivered, and results achieved. Reading case studies from your industry helps you visualize what’s possible and evaluate whether the partner’s approach matches your needs.

Understand the depth of their industry expertise. Have they only done basic implementations in your sector, or have they built sophisticated industry-specific customizations? A partner who’s implemented point-of-sale integration for retailers has surface-level retail experience. A partner who’s built advanced allocation engines, markdown optimization tools, and omnichannel fulfillment orchestration brings deep retail expertise.

Ask about industry-specific challenges they’ve solved. Every industry has common pain points—subscription revenue management for SaaS, size-color matrix handling for apparel, lot traceability for food manufacturers. Partners with genuine industry expertise can discuss these challenges fluently and describe multiple approaches they’ve used to address them.

Evaluate their network within your industry. Well-established industry specialists often have relationships with complementary solution providers, industry associations, and regulatory consultants. These connections provide value beyond just ERP implementation—they’re plugged into your industry ecosystem.

Consider geographic industry clusters. Some California regions have industry concentrations—tech in the Bay Area, entertainment in Los Angeles, agriculture in the Central Valley, wine in Napa. Partners serving these concentrated markets develop deep local industry expertise and understand region-specific nuances like California labor laws, water regulations, or entertainment union requirements.

Be cautious of partners claiming expertise in too many industries. Implementation consulting requires deep knowledge that’s difficult to maintain across wildly different sectors. A partner claiming equal expertise in SaaS, manufacturing, healthcare, retail, and construction probably has shallow knowledge of all rather than depth in any.

Talk to their consultants who’d actually work on your project, not just sales people. Sales representatives might claim broad industry experience the actual delivery team doesn’t possess. Insist on meeting the project manager and lead consultants to assess their industry fluency directly.

Assessing Technical Capabilities

Beyond industry knowledge, your partner needs solid technical skills to architect and build effective customizations.

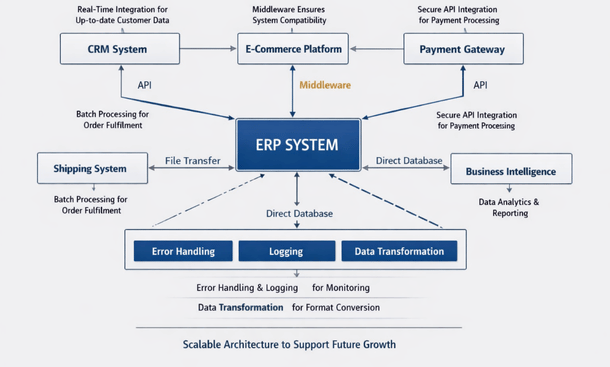

Evaluate their development capabilities on your specific ERP platform. Different platforms require different technical skills—SuiteScript for NetSuite, X++ for Dynamics, ABAP for SAP. Ask about their development team size, experience levels, and whether developers are onshore, offshore, or mixed. Understanding the team composition helps assess capability and communication considerations.

Ask about their approach to customization versus configuration. Quality partners maximize configuration before resorting to custom code. Partners who jump straight to custom development either lack platform knowledge or inflate projects to increase fees. Listen for nuanced understanding of when each approach makes sense.

Request examples of complex customizations they’ve built. Have them walk through technical architecture, integration patterns, and data models for sophisticated implementations. Their ability to explain technical decisions in business terms indicates both technical depth and communication skills.

Assess their integration expertise. Most implementations require connecting your ERP with other systems—CRM platforms, e-commerce sites, payment processors, shipping carriers, manufacturing equipment. Ask about integration approaches they use, APIs they’ve worked with, and how they handle error handling, logging, and monitoring.

Understand their testing methodologies. How do they ensure customizations work correctly? Do they have structured test plans, automated testing capabilities, and quality assurance processes? Partners without rigorous testing approaches create buggy implementations that require expensive fixes post-launch.

Ask about their development tools and environments. Quality partners use version control systems like Git to manage code, maintain separate development, testing, and production environments, and follow deployment processes that prevent production issues. These professional software development practices indicate maturity.

Evaluate their documentation standards. Well-documented customizations are maintainable long-term. Ask to see examples of technical documentation they’ve created. Good documentation includes architecture diagrams, data models, business rule specifications, and user guides. Poor documentation creates dependencies on the original developers.

Assess their upgrade and maintenance capabilities. How do they handle vendor platform updates? Do they test customizations after updates? What’s their process for modifying customizations as business needs evolve? Long-term maintenance matters as much as initial implementation.

Consider their bench strength. What happens if key consultants leave during your project or afterward? Partners with deep teams can substitute resources without derailing implementations. Small shops where one or two people possess all the knowledge create risky dependencies.

Understanding Their Implementation Methodology

How a partner approaches implementations reveals a lot about their professionalism and likelihood of success.

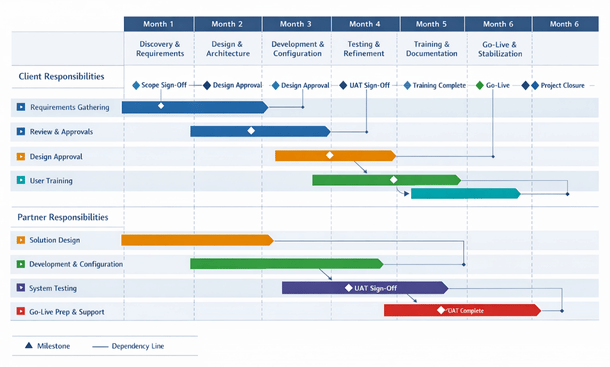

Ask them to describe their implementation methodology in detail. Quality partners have structured approaches with defined phases, deliverables, and decision points. Be suspicious of partners who can’t articulate a clear methodology or who say “every implementation is unique so we just figure it out as we go.”

Understand their requirements gathering process. How do they elicit and document your needs? Do they conduct workshops, interview stakeholders, observe current processes, and create detailed specifications? Requirements gathering often determines project success, so this phase deserves scrutiny.

Evaluate their project management approach. Who manages the project day-to-day? How do they track progress, manage risks, and handle issues? What tools do they use for communication and collaboration? Structured project management prevents implementations from drifting off track.

Ask about their change management philosophy. How do they help your organization adapt to new systems and processes? Do they provide training, create user documentation, and support users through transition? Technical implementation without change management creates adoption problems.

Understand their approach to scope management. How do they handle requirements that emerge mid-project? What’s the process for change requests? Partners with clear scope management prevent projects from ballooning out of control while remaining flexible enough to accommodate necessary adjustments.

Ask about their go-live strategy. Do they prefer big-bang cutovers or phased rollouts? How do they minimize disruption to operations? What’s their rollback plan if serious issues surface? Thoughtful go-live planning separates experienced partners from amateurs.

Evaluate their post-implementation approach. What happens after go-live? Do they provide hypercare support during stabilization? How long do they stay engaged to ensure success? Partners who disappear immediately after launch leave you vulnerable during the critical early production period.

Request to see project artifacts from past implementations—project plans, requirements documents, test plans, training materials. Reviewing actual deliverables shows their standards and attention to detail better than any sales presentation.

Checking References and Past Performance

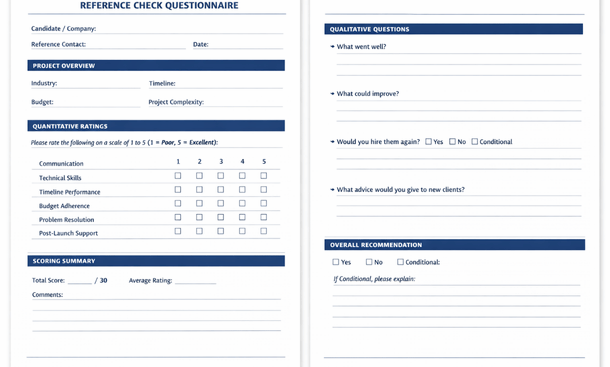

Don’t skip reference checks. Past performance is the best predictor of future results.

Ask for at least three references from implementations similar to yours—same industry, comparable size, similar complexity. References from vastly different implementations don’t provide relevant insights. A successful Fortune 500 enterprise implementation doesn’t predict success for your fifty-person startup.

Prepare specific questions for references beyond “were you happy?” Ask about timeline adherence, budget accuracy, communication quality, problem-solving ability, and post-implementation support. Ask what they’d do differently if starting over. Ask whether they’ve engaged the partner for additional work—repeat business indicates genuine satisfaction.

Ask references about challenges encountered and how the partner handled them. Every implementation faces obstacles. How partners respond to problems matters more than whether problems occur. References that describe effective problem-solving and transparent communication are more valuable than those claiming everything went perfectly.

Look for online reviews and testimonials beyond provided references. Partners naturally provide their best references. Search independently for reviews on platforms like Clutch, G2, or Google Business. Look for patterns in feedback—if multiple reviews mention poor communication, that’s probably a real issue.

Check for any legal issues, complaints, or disputes. Search court records, Better Business Bureau complaints, and licensing board actions. While an isolated complaint doesn’t necessarily disqualify a partner, patterns of problems should raise concerns.

Ask about their customer retention and repeat business rates. Partners who maintain long-term client relationships and win additional projects from satisfied customers probably deliver quality work. Those with high client churn likely have issues.

Verify their claimed implementation count and experience. Some partners exaggerate their track record. Ask specific questions that help verify claims: “You mentioned implementing for twenty manufacturers—can you name five and describe what you did for them?”

Don’t rely solely on references the partner provides. Try to find other clients through LinkedIn, industry associations, or your network. Unsolicited references provide unfiltered perspectives.

Trust your instincts during reference checks. If references seem coached, hesitate to share concerns, or damn with faint praise, dig deeper. Genuine enthusiasm and specific positive examples indicate real satisfaction.

Evaluating Communication and Cultural Fit

Technical skills matter, but so does working relationship quality. Poor communication and cultural misalignment create friction that undermines even technically competent implementations.

Assess their communication style during the sales process. Do they listen more than they talk? Do they ask insightful questions about your business? Do they explain things clearly or hide behind jargon? Sales interactions preview how they’ll communicate during implementation.

Evaluate responsiveness. How quickly do they respond to emails and calls? Are they easy to reach or does everything route through a sales representative? Responsiveness during the sales process usually degrades during implementation, so if they’re already slow, expect worse later.

Consider their consulting philosophy. Do they position themselves as order-takers who’ll build whatever you request, or as advisors who’ll challenge your assumptions and suggest better approaches? You want partners confident enough to push back when you’re heading in a wrong direction.

Assess whether they understand entrepreneurship and small business dynamics. Large consulting firms accustomed to enterprise budgets and bureaucratic decision-making might struggle with the speed, resource constraints, and hands-on involvement typical in smaller businesses. Find partners who match your operational style.

Consider team dynamics. Will you work with a consistent team or get rotated through various consultants? Consistency matters for building relationships and maintaining project continuity. Frequent team changes create inefficiencies and communication breakdowns.

Evaluate their transparency about challenges and limitations. Partners who promise everything and claim no concerns are either naive or dishonest. Experienced partners acknowledge potential difficulties and discuss mitigation strategies openly.

Consider location and time zone alignment. While remote work enables partnerships across geographies, some time zone and location overlap facilitates communication. California businesses working with East Coast partners manage time differences. International offshore teams require even more coordination. Assess whether geographic factors will create communication friction.

Trust your gut about personality fit. You’ll spend months working closely with these people. If you don’t enjoy conversations during the sales process or feel talked down to, those feelings will intensify under project pressure. Life’s too short to work with people you don’t like.

Understanding Pricing Models and Contract Terms

Pricing structure impacts both total cost and how well incentives align between you and your partner.

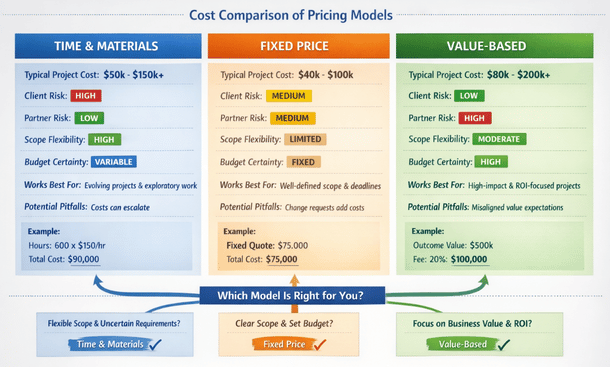

Understand the pricing model—time-and-materials, fixed-price, or value-based. Each has advantages and disadvantages. Time-and-materials provides flexibility but creates budget uncertainty. Fixed-price transfers risk to the partner but requires extremely clear scope. Value-based pricing aligns incentives but demands trust and measurable outcomes.

For time-and-materials projects, get detailed rate cards showing costs for different resource types. Senior consultants should cost more than junior ones. Onshore resources typically cost more than offshore. Understand the full cost structure including project management, travel, and any markup on software licenses or third-party tools.

For fixed-price projects, scrutinize scope definition and change order processes. The devil lives in the details of what’s included versus excluded. Vague scope definitions give partners opportunities to charge for work you expected to be included. Clear scope plus fair change order processes protect both parties.

Ask about payment terms and schedules. Avoid partners demanding large upfront payments before delivering value. Milestone-based payments tied to deliverables protect you by ensuring you only pay for completed work. Typical structures might be 25% at contract signing, 25% at design approval, 25% at development completion, and 25% at successful go-live.

Understand what’s included in base pricing versus add-ons. Does the quote include training? Documentation? Post-launch support? Travel expenses? Third-party software licenses? Hidden costs inflate actual expenses well beyond initial quotes. Demand comprehensive proposals showing total cost of ownership.

Clarify intellectual property ownership. Do you own customizations built for your implementation, or does the partner retain rights? This matters if you later want to modify customizations yourself or switch partners. Ensure contracts clearly grant you ownership of custom work you’ve paid for.

Review warranty and guarantee terms. What happens if customizations don’t work as specified? Does the partner provide any performance guarantees? What’s the remedy if they fail to deliver? Strong partners stand behind their work with meaningful commitments.

Understand how scope creep and change requests are handled. What’s the process for requesting changes? How are additional costs calculated? How quickly must you approve changes? Clear change management prevents surprise bills and scope disputes.

Compare total proposals, not just hourly rates. A partner quoting $200/hour who finishes in 200 hours costs $40,000. A partner quoting $150/hour who takes 350 hours costs $52,500. Efficiency and expertise matter more than raw hourly rates. Focus on total expected investment and value delivered.

Post-Implementation Support and Maintenance

Your relationship with your implementation partner shouldn’t end at go-live. Ongoing support and maintenance matter for long-term success.

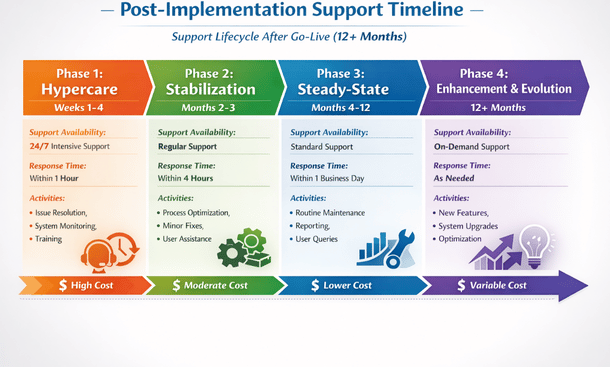

Understand what post-launch support is included. Most partners provide some hypercare period immediately after go-live—typically two to four weeks of elevated support as you stabilize on the new system. Clarify response times, hours of coverage, and what issues are covered during this phase.

Ask about ongoing support options after hypercare ends. Can you purchase support retainers or prepaid block hours? What response times apply for different issue severities? What’s covered versus what incurs additional charges? Having clear support options prevents scrambling when issues arise months after implementation.

Evaluate their enhancement and continuous improvement approach. As your business evolves, you’ll need customization modifications and new features. Can your implementation partner provide ongoing development? Do they offer strategic advisory services to help plan enhancements? Long-term relationships are more efficient than starting over with new partners.

Ask about their upgrade and maintenance services. When your ERP vendor releases updates, can your partner test customizations, fix compatibility issues, and manage the upgrade process? This ongoing maintenance prevents you from getting stuck on outdated versions.

Understand staff turnover and knowledge retention. What happens if consultants who built your customizations leave the partner firm? Do they maintain documentation and institutional knowledge that enables other consultants to support your system? Partners with high turnover create support challenges.

Consider training and knowledge transfer during implementation. The more your internal team understands about customizations, the less dependent you’ll be on external support. Quality partners emphasize knowledge transfer so you can handle routine maintenance and simple modifications independently.

Evaluate their client communication practices. Do they proactively reach out with platform updates, security patches, or optimization suggestions? Partners who maintain active client relationships provide more value than those you only hear from when you need help.

Ask about their client success or account management approach. Larger partners often assign account managers who check in regularly, understand your evolving needs, and coordinate additional services. This ongoing relationship management creates smoother long-term partnerships.

Assess their pricing for ongoing support. Is it reasonable and predictable? Do they offer volume discounts or loyalty programs for long-term clients? Ensure long-term support costs fit your budget and expectations.

Making Your Final Decision

After evaluating multiple partners across all these dimensions, how do you actually make the final choice?

Create a structured scorecard evaluating each partner against your priority criteria. Don’t rely on gut feel alone—quantify assessments where possible. Rate partners on dimensions like technical capability, industry expertise, methodology, references, communication, pricing, and cultural fit. Weighted scoring based on your priorities produces data-driven decisions.

Involve key stakeholders in the decision. The people who’ll work with the partner daily—your operations manager, finance director, IT lead—should meet finalists and provide input. Their buy-in matters for successful collaboration during implementation.

Consider running a paid pilot or proof-of-concept with your top choice. For large implementations, spending $10,000-$15,000 for a partner to prototype a complex customization or conduct detailed requirements gathering provides valuable validation before committing to the full project. You’ll see their actual work quality and collaboration style, not just sales presentations.

Trust your instincts alongside data. If a partner scores well analytically but something feels off, don’t ignore that intuition. Conversely, if you feel great about a partner who scores lower in some areas, those concerns might be surmountable. Balance analytical evaluation with human judgment.

Negotiate firmly but fairly. Once you’ve selected a partner, negotiate contract terms that protect your interests while being reasonable. Strong partners appreciate clients who negotiate professionally and establish clear mutual expectations. Unreasonable demands or penny-pinching on a partner you’ve chosen creates a poor foundation for collaboration.

Plan for a smooth transition from sales to implementation. Sales people often promise things delivery teams can’t deliver. Insist on meeting the actual project team and project manager before signing contracts. Confirm that what was discussed during sales will be honored during implementation. Get key commitments in writing.

Set clear expectations and success criteria upfront. Document what success looks like, establish communication protocols, define decision-making processes, and agree on escalation paths. Taking time to align expectations prevents conflicts during the high-pressure implementation phase.

Maintain realistic expectations. Even the best partner can’t overcome poorly defined requirements, inadequate client involvement, or unrealistic timelines. Your contributions to success matter as much as your partner’s capabilities. Approach implementation as a collaboration requiring active engagement from both sides.

Ready to dive deeper into the customization decisions your partner will help you make? Check out our guide on the types of ERP customization to understand your options. And for comprehensive guidance on the entire customization journey, our complete resource on tailoring your system to your business covers everything from planning through ongoing optimization.

Choosing the right ERP customization partner sets the foundation for successful implementation and long-term system success. Take the time to evaluate thoroughly, and you’ll build a relationship that delivers compounding value as your business grows and evolves. The effort you invest in partner selection pays dividends throughout your entire ERP journey.

Did you find this helpful?

Your feedback helps us curate better content for the community.