Here’s a question I get all the time from nonprofit leaders across California: “Do we need full ERP software, or is fund accounting enough?” Honestly, it’s one of the most important decisions you’ll make for your organization’s tech stack. Fund accounting platforms handle the basics beautifully—tracking restricted funds, generating GAAP-compliant reports—but ERPs bring integrated program management, CRM, and operational workflows into the mix. The right choice depends on your size, complexity, and growth trajectory. As you weigh these options, our in-depth exploration of ERP solutions designed for nonprofit organizations offers valuable perspective on when to graduate from standalone accounting tools to comprehensive enterprise systems.

Understanding the core difference

Let’s clear up the confusion right from the start because these terms get thrown around interchangeably when they’re actually quite different.

Fund accounting software is specialized accounting designed for nonprofits. It tracks financial transactions using fund-based structures instead of profit-and-loss models. You can manage restricted and unrestricted funds, generate nonprofit financial statements, handle grant budgets, and produce reports that satisfy auditors and funders. Think QuickBooks Nonprofit Edition, Aplos, or Nonprofit Treasurer—focused tools that do nonprofit accounting really well.

ERP systems are comprehensive platforms that integrate accounting with everything else your organization does. Finance, donor management, grant tracking, program services, HR, inventory, and reporting all live in one connected system. Data flows automatically between modules without manual imports and exports. NetSuite, Dynamics 365, Sage Intacct, and Blackbaud Financial Edge NXT fall into this category.

The core difference boils down to scope. Fund accounting software handles your books. ERP systems handle your entire organization. That might sound like ERPs always win, but that’s not true. The right answer depends on what problems you’re actually trying to solve.

Another way to think about it—fund accounting software is like having a really good financial calculator. ERP is like having a complete business operating system. Both have their place depending on your needs.

What fund accounting software does well

Fund accounting platforms have legitimate advantages that make them the right choice for many California nonprofits.

Simplicity and ease of use top the list. These systems are designed specifically for nonprofit finance staff, not enterprise IT departments. The learning curve is manageable. Most team members become comfortable within a few weeks. You don’t need consultants or technical expertise to get started.

Lower upfront costs make fund accounting accessible. Entry-level solutions like Aplos or QuickBooks Nonprofit run $50 to $200 monthly. Mid-tier platforms like Nonprofit Treasurer or AccountEdge Nonprofit cost $100 to $500 monthly. Even high-end fund accounting like Abila MIP rarely exceeds $3,000 monthly. Implementation often takes weeks rather than months, keeping consulting costs reasonable.

Focused functionality means these systems do accounting really well. Fund tracking, grant accounting, allocation of expenses across programs and funding sources, nonprofit financial statements, Form 990 preparation support—the core accounting features you need are polished and reliable.

Quick implementation gets you operational fast. Small nonprofits can be up and running on fund accounting software in two to six weeks. You’re not embarking on a six-month transformation project. You install software, import data, configure basics, train users, and go.

Vendor support tends to be accessible and affordable. Companies selling fund accounting software understand nonprofits operate on tight budgets. Support is typically included or available at reasonable costs. You’re not paying enterprise-level consulting rates for basic assistance.

For organizations with straightforward needs, fund accounting delivers everything required without unnecessary complexity or expense. A community foundation managing $2 million in assets, a local food bank with $800,000 in revenue, or an arts nonprofit with a small development program probably don’t need full ERP capabilities.

When ERP systems make more sense

As nonprofits grow and operations become more complex, fund accounting limitations become increasingly painful.

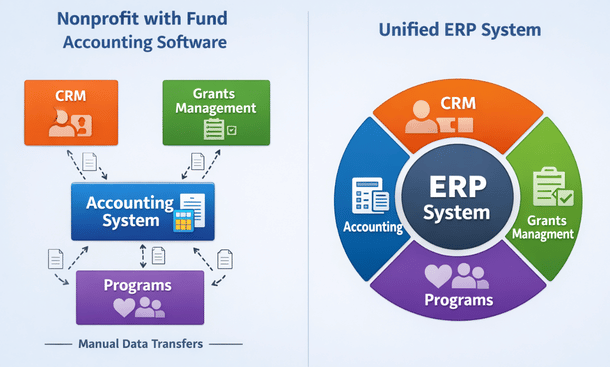

Integration challenges emerge when you’re managing multiple disconnected systems. Your fund accounting software handles finances. Your CRM manages donors. Your grants database tracks compliance. Your program database records client services. Moving data between these systems creates work, introduces errors, and prevents real-time visibility.

I’ve watched California nonprofits spend dozens of hours monthly exporting data from their CRM, reformatting in Excel, and importing into accounting. Then reconciling when the numbers don’t match. Then generating reports by pulling data from three systems and combining manually. This isn’t productive work—it’s system-induced overhead.

Scalability becomes an issue as you grow. Fund accounting software often has limits on transaction volumes, number of grants you can track, or reporting complexity it can handle. At some point, you outgrow the platform and face a painful migration anyway.

Reporting across organizational functions is nearly impossible with disconnected systems. Your board wants to see fundraising performance, program outcomes, and financial health in one dashboard. With separate systems, this requires manual report assembly. With an ERP, it’s a single report pulling live data.

Multi-entity operations struggle with fund accounting. If you have chapters, affiliates, or multiple legal entities that need consolidation, most fund accounting software can’t handle this. You end up with separate instances and manual consolidation processes.

Workflow automation and approvals are limited in fund accounting platforms. ERPs let you build sophisticated approval workflows, automated journal entries, scheduled reports, and business process automation that eliminates repetitive manual tasks.

Advanced analytics and business intelligence require ERP-level data integration. When all your organizational data lives in one system, you can analyze relationships between fundraising activities and donor retention, program costs and outcomes, or staff capacity and service delivery in ways that disconnected systems prevent.

Organizations hitting these pain points benefit enormously from ERP migration. A homeless services org managing $15 million across government contracts and foundation grants, operating three locations, serving thousands of clients annually, and employing 80 staff needs ERP capabilities, not just fund accounting.

Cost comparison and ROI analysis

Let’s talk money because budget constraints are real for every nonprofit.

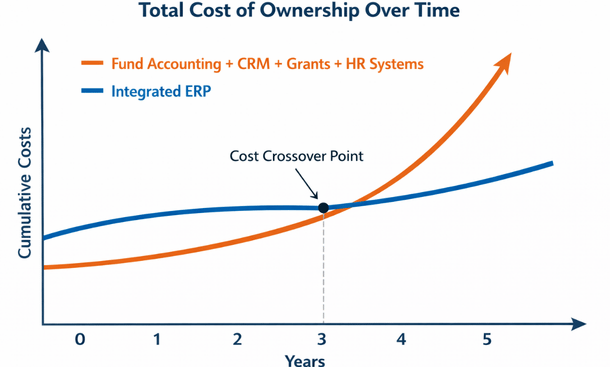

Fund accounting software costs break down simply. Monthly subscription or annual licensing runs $600 to $6,000 yearly for most organizations. Implementation might cost $2,000 to $15,000 depending on complexity. Training is often minimal. Total first-year cost typically lands between $5,000 and $25,000.

ERP systems carry significantly higher price tags. Annual licensing ranges from $15,000 to $150,000 depending on the platform, modules, and user count. Implementation services run $30,000 to $200,000 for professional configuration, data migration, and training. First-year total investment typically hits $50,000 to $300,000.

Those numbers make fund accounting look like an obvious choice, but total cost of ownership tells a different story.

With fund accounting, you’re also paying for separate CRM ($2,000 to $12,000 annually), grants management software ($3,000 to $15,000), program databases (varies widely), integration tools or middleware ($1,000 to $10,000), and staff time managing all these systems and moving data between them.

When you calculate the full ecosystem cost—software subscriptions, integration expenses, consultant fees to connect systems, and the opportunity cost of staff time wasted on data manipulation—the gap narrows considerably.

ROI analysis should include efficiency gains. One environmental nonprofit in the Bay Area calculated they were spending 25 hours weekly on tasks that became automated after ERP implementation. At an average hourly cost of $35 including benefits, that’s $45,500 in annual labor savings. The ERP paid for itself in efficiency gains within two years.

Better decision-making has value too. Real-time dashboards, integrated reporting, and data-driven insights lead to better strategic choices. How much is it worth to know within hours instead of weeks that a program is running over budget or that a fundraising campaign is underperforming?

For small nonprofits with budgets under $2 million, simple structures, and limited growth plans, fund accounting usually makes financial sense. For organizations with budgets over $5 million, multiple programs, complex reporting needs, or aggressive growth trajectories, ERP ROI becomes compelling despite higher upfront costs.

Integration and ecosystem considerations

The decision isn’t always binary. Your broader technology ecosystem influences which approach works best.

Modern fund accounting platforms offer more integration capabilities than they used to. APIs, Zapier connections, and pre-built integrations with popular CRMs and donation platforms make it possible to create reasonably connected systems without full ERP investment.

If you’re using best-of-breed tools that integrate well, a fund accounting core might work fine. For example, if you run Salesforce Nonprofit Cloud for constituent management, integrated with Blackbaud’s fund accounting or Sage Intacct, connected to your donation processor and email marketing, you’ve essentially built an ERP ecosystem from multiple specialized tools.

This approach gives you flexibility to choose the best tool for each function rather than compromising on an all-in-one platform’s mediocre features. The trade-off is increased complexity managing multiple vendor relationships, integration points that can break, and the need for technical expertise to maintain the ecosystem.

Cloud-based platforms make integration easier than legacy systems. Whether you choose fund accounting with integrations or a unified ERP, prioritize cloud solutions with modern APIs. Trying to connect on-premise legacy systems creates technical nightmares.

Data security and compliance deserve consideration. Managing data across multiple platforms means more points of potential vulnerability. Ensuring consistent security standards, backup procedures, and access controls across your technology stack requires diligence. Unified ERP platforms centralize security management.

Making the decision for your organization

Here’s a practical framework for making this choice based on real organizational factors.

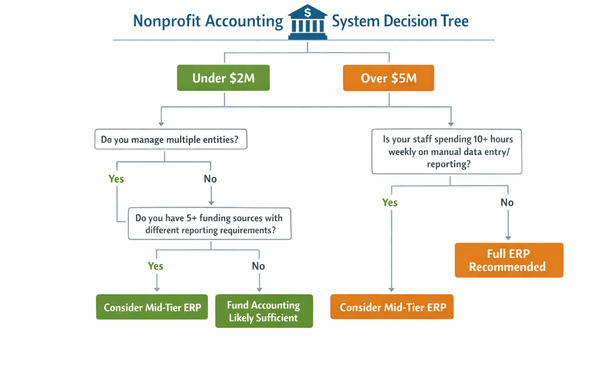

Organization size and budget provide initial guidance. Under $1 million in revenue—fund accounting almost certainly makes sense. Between $1 million and $5 million—it depends on complexity. Over $5 million—seriously consider ERP, especially if you’re growing.

Number and complexity of funding sources matters enormously. Managing five straightforward grants is fine in fund accounting. Tracking 30 grants with different reporting requirements, compliance rules, and budget structures screams for ERP capabilities.

Program diversity and complexity influence needs. Running one program out of a single location with simple service delivery is different from operating five programs across multiple sites with complex client tracking and outcomes measurement.

Staff capacity and technical expertise affect implementation success. Do you have people who can manage complex systems? Can you dedicate staff time to implementation? Small teams stretched thin often succeed better with simpler fund accounting than struggling with under-resourced ERP implementations.

Growth trajectory and strategic plans look forward. If you’re planning to double in size over the next three years, add new programs, expand geographically, or significantly increase funding complexity, choose systems that can scale with you rather than needing replacement soon.

Reporting and compliance requirements vary wildly. Organizations with heavy government funding, complex funder reporting, or multiple audits need robust systems. Simple donor bases and straightforward financials have less demanding requirements.

Current pain points reveal a lot. If your team complains constantly about manual data entry, reconciliation challenges, or inability to get timely reports, your current approach isn’t working regardless of your size.

Hybrid approaches and migration paths

The choice isn’t always permanent or all-or-nothing. Smart migration strategies let you evolve as needs change.

Start with fund accounting and migrate later is a common path. Many California nonprofits begin with QuickBooks or similar when they’re small, then migrate to ERP when complexity or scale demands it. This works fine if you accept you’ll eventually face a data migration project.

Use mid-tier solutions as stepping stones. Platforms like Sage Intacct or Acumatica offer ERP capabilities at price points between basic fund accounting and enterprise systems. They provide growth runway without massive upfront investment.

Implement ERP in phases to spread costs and complexity. Start with financial management, then add CRM, then grants management, then program modules over time. This approach reduces initial investment and lets your team adapt gradually.

Maintain fund accounting but integrate thoroughly with other best-of-breed tools. If your fund accounting software has solid integration capabilities, building a connected ecosystem of specialized tools might serve you better than a mediocre all-in-one ERP.

The key is being honest about your current situation and realistic about your future. Don’t over-invest in enterprise capabilities you won’t use. But don’t under-invest in infrastructure that’s already limiting your impact.

Plan migration timing strategically. Fiscal year boundaries, leadership transitions, major funding changes, or facility moves often provide natural windows for system changes. Avoid implementing during your busiest program seasons or major fundraising campaigns.

Choosing between fund accounting software and a full ERP system isn’t about which technology is objectively better—it’s about which matches your nonprofit’s current reality and future trajectory. The organizations that make this decision well are those that honestly assess their needs, budget realistically for total cost of ownership, and choose systems aligned with their strategic plans rather than just solving today’s problems. Whether you land on focused fund accounting or comprehensive ERP capabilities, understanding what you’re actually getting helps you maximize your investment and advance your mission. For deeper insights into what makes nonprofit-specific ERP systems different and whether they’re right for your organization, explore our foundational guide on what nonprofit ERP software is and how it works. And to see the complete strategic picture of how technology choices support your nonprofit’s operational excellence, check out our comprehensive guide to ERP for nonprofits.